MAWIP 2023

- Get link

- X

- Other Apps

Hasil Perbendaharaan US pada akhir curve rose yang lebih panjang meningkat seiring dengan jangkaan inflasi pada hari Khamis ketika pasaran melihat prospek untuk tambahan hutang di bawah pentadbiran US yang baru

Aroon

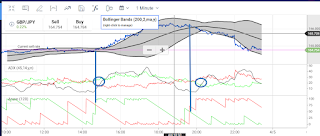

The Aroon Indicators are a pair of momentum indicators – the Aroon Up value and Aroon Down value – named after the Sanskrit word for the first light of day. Each indicator represents a standardized value for the strength of the upward or downward pressure on a stock, which analysts can compare to determine if there is a trend emerging. Aroon looks at the latency between highs for certain rolling time periods, with 25 days being the standard time frame.

The Aroon indicator is calculated using the number of days since the most recent (25-day) high and low. The values are put on a scale between 1-100 using a multiplier which takes the length of the time frame into account. 50 is the median value, and if the Up or Down is over 50, it may indicate significant pressure in that direction if the other one is below 50.

When the Aroon Down is above the 70 line and the Aroon Up is below the 30 line, it could be an indication that the security is in a downtrend. Traders may consider selling the security, selling it short, or exploring put options. When Aroon Up is above the 70 line and Aroon Down is below the 30 line, it could be a signal that the security is in an uptrend. Traders may consider going long the security or exploring call options.

Click here to view the current news with the use of Aroon Indicators

If the Up is above 50 and the Down is below 50, it indicates that bullish momentum is present, and the opposite indicates bearish momentum. The two can also be compared to each other regardless of where they lie in relation to 50: an Aroon Up over an Aroon Down signals a bullish sign, while Aroon Down over Aroon Up is bearish. The Aroon indicators can be combined into one scale by flipping the values around and making the scale go from 100 to -100; this is also known as the Aroon Oscillator.

The Aroon Indicators are similar to the Directional Movement Index (DMI) and the Aroon Oscillator is similar to the Average Directional Index (ADX). The Directional Movement Index (DMI) combines the average directional index (ADX), plus directional indicator (+DI), and minus directional indicator (-DI) into one graph that depicts the strength of positive or negative market forces. By plotting the directional indicators together with the ADX line, traders can get a sense of overall movement and determine a trend’s strength and direction.

Traders use technical indicators like Aroon Indicators to make predictions about future prices. They verify how well a specific indicator works for a particular security. No single indicator works well for all securities, but they should not be discounted. The Aroon indicators should be used with other indicators, price analysis, and tools to mitigate risk and misleading signals. Artificial intelligence services from Tickeron provide traders with a powerful way to evaluate trade ideas, analyze signals, and provide key confirmation to help investors make rational, emotionless, and effective trading decisions.

How to Calculate the Commodity Channel Index

- Determine how many periods your CCI will analyze. Twenty is commonly used. Fewer periods result in a more volatile indicator, while more periods will make it smoother. For this calculation, we will assume 20 periods. Adjust the calculation if using a different number.

- In a spreadsheet, track the high, low, and close for 20 periods and compute the typical price.

- After 20 periods, compute the moving average (MA) of the typical price by summing the last 20 typical prices and dividing by 20.

- Calculate the mean deviation by subtracting the MA from the typical price for the last 20 periods. Sum the absolute values (ignore minus signs) of these figures and then divide by 20.

- Insert the most recent typical price, the MA, and the mean deviation into the formula to compute the current CCI reading.

- Repeat the process as each new period ends.

What Does the Commodity Channel Index Tell You?

The CCI is primarily used for spotting new trends, watching for overbought and oversold levels, and spotting weakness in trends when the indicator diverges with price.

When the CCI moves from negative or near-zero territory to above 100, that may indicate the price is starting a new uptrend. Once this occurs, traders can watch for a pullback in price followed by a rally in both price and the CCI to signal a buying opportunity.

:max_bytes(150000):strip_icc():format(webp)/dotdash_INV-final-Commodity-Channel-Index-CCI-June-2021-01-45a136bc81d746acbc178b6f4afc07c2.jpg)

Image by Sabrina Jiang © Investopedia 2021

The same concept applies to an emerging downtrend. When the indicator goes from positive or near-zero readings to below -100, then a downtrend may be starting. This is a signal to get out of longs or to start watching for shorting opportunities.

Despite its name, the CCI can be used in any market and is not just for commodities.

Overbought or oversold levels are not fixed since the indicator is unbound. Therefore, traders look at past readings on the indicator to get a sense of where the price reversed. For one stock, it may tend to reverse near +200 and -150. Another commodity, meanwhile, may tend to reverse near +325 and -350. Zoom out on the chart to see lots of price reversal points, and the CCI readings at those times.

There are also divergences—when the price is moving in the opposite direction of the indicator. If the price is rising and the CCI is falling, this can indicate a weakness in the trend. While divergence is a poor trade signal, since it can last a long time and doesn't always result in a price reversal, it can be good for at least warning the trader that there is the possibility of a reversal. This way, they can tighten stop loss levels or hold off on taking new trades in the price trend direction.

The Commodity Channel Index vs. the Stochastic Oscillator

Both of these technical indicators are oscillators, but they are calculated quite differently. One of the main differences is that the Stochastic Oscillator is bound between zero and 100, while the CCI is unbounded.

Due to the calculation differences, they will provide different signals at different times, such as overbought and oversold readings.

Limitations of Using the Commodity Channel Index

While often used to spot overbought and oversold conditions, the CCI is highly subjective in this regard. The indicator is unbound and, therefore, prior overbought and oversold levels may have little impact in the future.

The indicator is also lagging, which means at times it will provide poor signals. A rally to 100 or -100 to signal a new trend may come too late, as the price has had its run and is starting to correct already.

Such incidents are called whipsaws; a signal is provided by the indicator but the price doesn't follow through after that signal and money is lost on the trade. If not careful, whipsaws can occur frequently. Therefore, the indicator is best used in conjunction with price analysis and other forms of technical analysis or indicators to help confirm or reject CCI signals.

- Get link

- X

- Other Apps

Comments

Post a Comment